United Airlines (UA, or UAL) is among the leading airline in the United States, and one of the founding members of the Star Alliance. The airline flies to more than 300 destinations worldwide from 8 primary hubs in the U.S.

Frequent flyers of United Airlines are offered various beneficial programs such as the award-winning MileagePlus Loyalty Program, and MileagePlus credit cards.

Today, we will be discussing the requirements, and benefits of the various United Airlines personal credit cards.

Table of Contents

What is the United MileagePlus Credit Card?

There are two different types of United MileagePlus Credit cards: Personal Credit Cards, and Business Credit Cards. Both credit cards have their own requirements, purposes, and benefits.

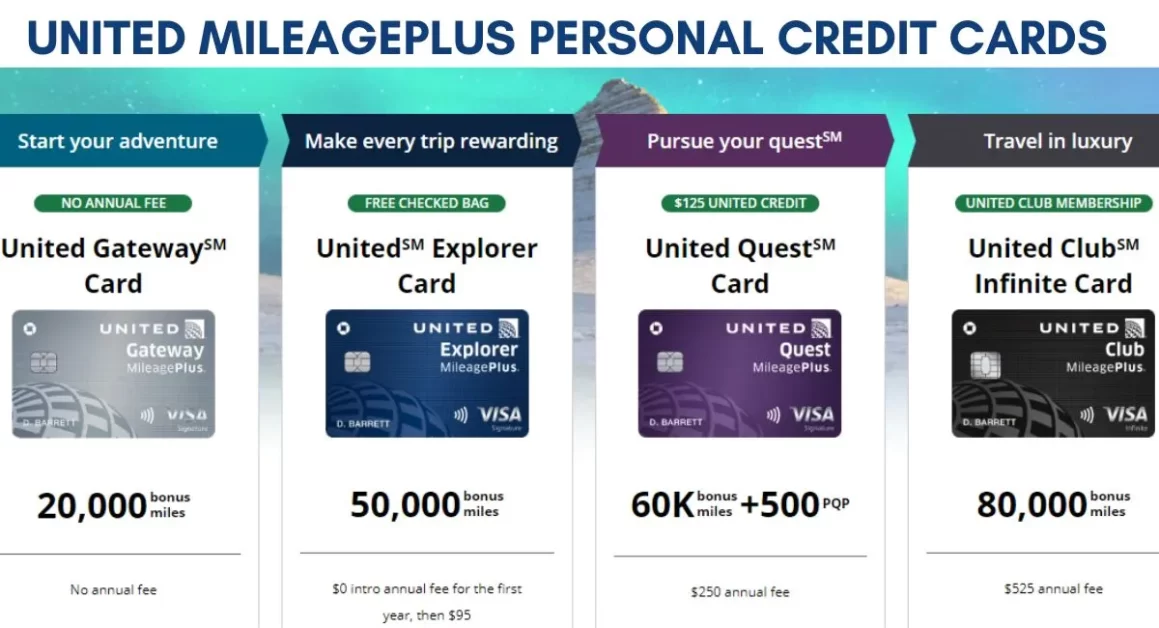

MileagePlus Personal credit card is offered to eligible passengers flying on United flights. There are four types of personal credit cards including the United Gateway Card, United Explorer Card, United Quest Card, and United Club Infinite Card.

- United Gateway Card (Entry-Level Card)

- United Explorer Card (For Travel needs)

- United Quest Card (To fulfill your quest)

- United Club Infinite Card (Best for United Club membership)

All United MileagePlus credit cards are offered by Chase Bank. The following table shows the varieties of the United Airlines Personal Credit Card with their bonus miles and annual fee.

| TYPES OF UNITED MILEAGEPLUS CARD | BONUS MILES | ANNUAL FEE |

| United Gateway Card | 20,000 miles | No Annual Fee |

| United Explorer Card | 50,000 miles | $0 for the 1st year, then $95 |

| United Quest Card | 60,000 miles + 500 PQP (Premier Qualifying Points) | $250 |

| United Club Infinite Card | 80,000 miles | $525 |

Now, let’s explore all the United MileagePlus personal credit cards in detail.

United Gateway Card

The Gateway Card is the entry-level product of the United MileagePlus personal credit card that offers limited benefits to start your adventure with United Airlines.

No annual fee

0% intro APR for 12 months from account opening on purchases

2x miles on United purchases

2x miles on gas, local transit and commuting

Customers can apply for the Gateway Card by submitting personal information, and financial details via the online platform. A FICO Credit score of 660 to 850 is required to be eligible for the United Gateway Card.

If approved, the airline will provide the Gateway Card that can be used for purchases to earn miles.

Gateway Cardholders can earn 20,000 bonus miles after spending $1,000 on purchases in the first 3 months of account opening. There is no annual fee for using this card.

Plus, there is a 0% intro APR applicable for the first 12 months from account opening on purchases. After that, an APR ranging from 20.74% to 27.74% is applicable.

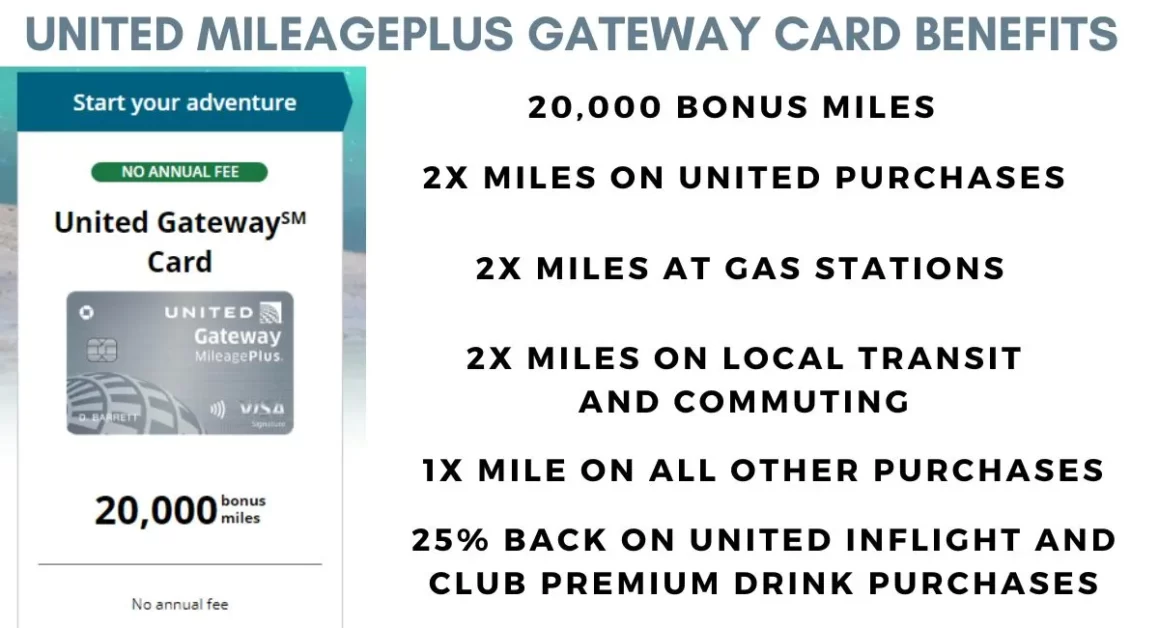

United Gateway Card Benefits

- No Annual Fee

- Earn 2X miles on United purchases.

- Earn 2X miles at gas stations.

- Earn 2X miles on local transit and commuting including ride-share services, taxicabs, train tickets, tolls, and mass transit.

- Earn 1X mile on all other purchases.

- 25% back on United inflight and Club premium drink purchases.

- No Foreign Transaction Fees.

- No blackout dates for MileagePlus members booking award flights on United.

- No expiration for MileagePlus Miles.

- Travel Coverage includes Auto Rental Collision Damage Waiver, Trip Cancellation/Interruption Insurance, Purchase Protection, and more.

- Complimentary Cardmember benefits at luxury hotels, and resorts worldwide.

- Enjoy a 1-year complimentary DashPass (provides unlimited deliveries with $0 delivery fees, and lower service fees on eligible orders).

- Exclusive Cardmember events offered by United Card events from Chase and United MileagePlus Exclusives.

United Explorer Card

The Explorer Card is offered to make your trip rewarding as it features various benefits to meet your travel needs.

Free First Checked Bag

2x miles on United purchases

2x miles on Dining and Hotels

Up to 1,000 PQP (Premier Qualifying Points)

United Club passes

Eligible customers can apply for the United Explorer card online by submitting personal information, and financial details. At least a 670 credit score plus a strong financial status is required for the Explorer card. Customers are provided with an Explorer credit card once the application is approved.

Explorer Card members can earn 50,000 bonus miles after spending $3,000 on purchases in the first 3 months of account opening. The annual fee for using the Explorer Card is $95 however, the annual fee is $0 for the first year as part of the intro offer.

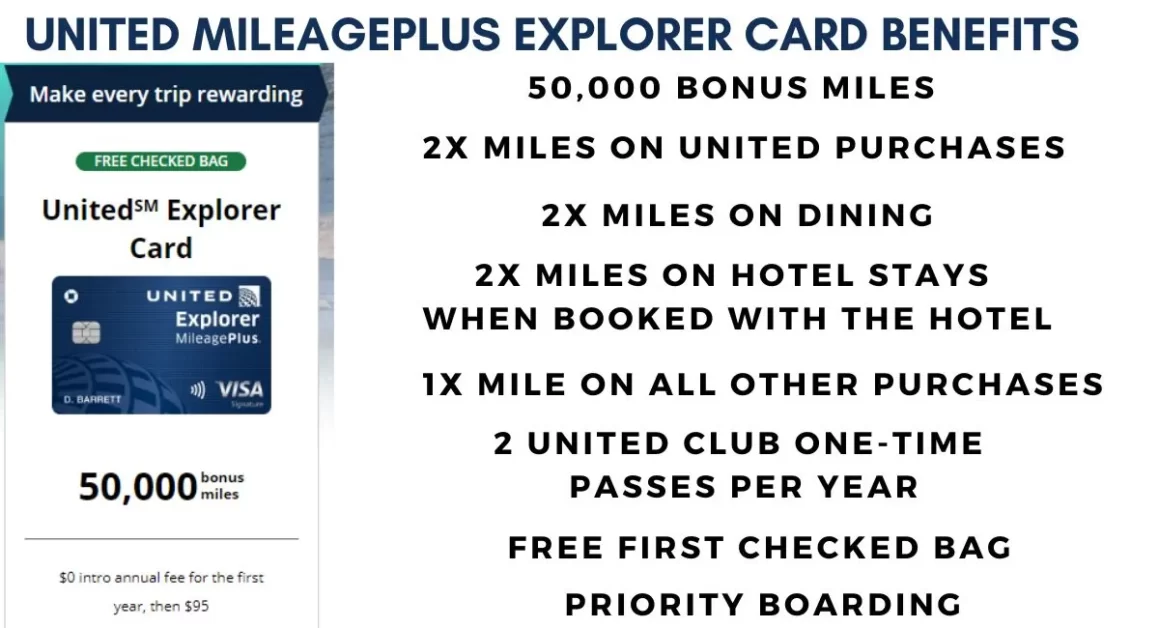

United Explorer Card Benefits

- $0 intro annual fee for the first year.

- Earn 2X miles on United purchases.

- Earn 2X miles on dining including eligible delivery services.

- Earn 2X miles on hotel stays when booked with the hotel.

- Earn 1X mile on all other purchases.

- Enjoy 2 United Club one-time passes per year (Worth $100+).

- Free First Checked Bag for you and your companion (Up to $140 savings per roundtrip).

- Priority Boarding

- Up to $100 Global Entry, TSA PreCheck, or NEXUS fee credit.

- 25% back on United inflight and Club premium drink purchases.

- No Foreign Transaction Fees.

- Earn up to 1,000 PQP (Premier Qualifying Points) to qualify for MileagePlus status levels.

- No Blackout dates for MileagePlus members booking award flights on United.

- No expiration on MileagePlus miles.

- Travel Coverage includes Auto Rental Collision Damage Waiver, Trip Cancellation/Interruption Insurance, Purchase Protection, and more.

- Complimentary Cardmember benefits at luxury hotels, and resorts worldwide.

- Enjoy a 1-year complimentary DashPass (provides unlimited deliveries with $0 delivery fees, and lower service fees on eligible orders).

- Exclusive Cardmember events offered by United Card events from Chase and United MileagePlus Exclusives.

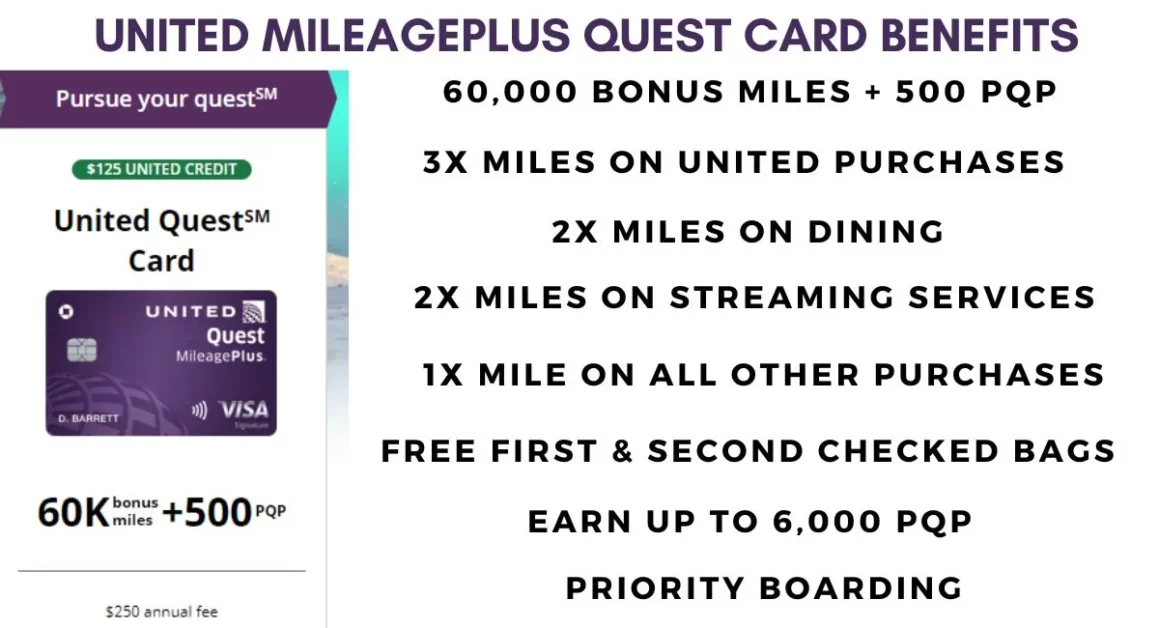

United Quest Card

As the name suggests, United Quest Card is there to fulfill your quest to travel. It comes with enhanced benefits compared to the previous two personal credit cards.

$125 annual United purchase credit

3x miles on United purchases

Free Checked Baggage

Up to 6,000 PQP (Premier Qualifying Points)

Two 5,000-mile anniversary award flight credits

If your credit score is 700 or more, you are in good standing to apply for the United Quest Card. You can visit the official website, and apply for the Quest Card by submitting your personal information, financial details, and other important forms.

United Quest cardholders can earn 60,000 Bonus Miles plus 500 PQP (Premier Qualifying Ponts) after spending $4,000 on purchases in the first 3 months of account opening. The annual fee for using the Quest Card is $250.

United Quest Card Benefits

- Earn 3x miles on United purchases after earning your $125 annual United purchase credit.

- Earn 2x miles on all other travel itineraries including airfare, trains, local transit, cruise lines, hotels, car rentals, taxicabs, resorts, ride-share services, and tolls.

- Earn 2x miles on dining including eligible delivery services.

- Earn 2x miles on select streaming services.

- Earn 1x miles on all other purchases.

- Receive a $125 annual United purchase credit.

- Enjoy two 5K-mile anniversary award flight credits applicable on United or United Express-operated award flights.

- Complimentary 1st and 2nd Checked Bags.

- Priority Boarding

- Up to $100 Global Entry, TSA PreCheck, or NEXUS Fee credit.

- 25% back on United inflight and Club Premium drink purchases.

- No foreign transaction fees.

- Earn up to 6,000 PQP (Premier Qualifying Points) to qualify for MileagePlus Status levels.

- No Blackout dates for MileagePlus members booking award flights on United.

- No expiration on MileagePlus miles.

- Travel Coverage includes Auto Rental Collision Damage Waiver, Trip Cancellation/Interruption Insurance, Purchase Protection, and more.

- Complimentary Cardmember benefits at luxury hotels, and resorts worldwide.

- Enjoy a 1-year complimentary DashPass (provides unlimited deliveries with $0 delivery fees, and lower service fees on eligible orders).

- Exclusive Cardmember events offered by United Card events from Chase and United MileagePlus Exclusives.

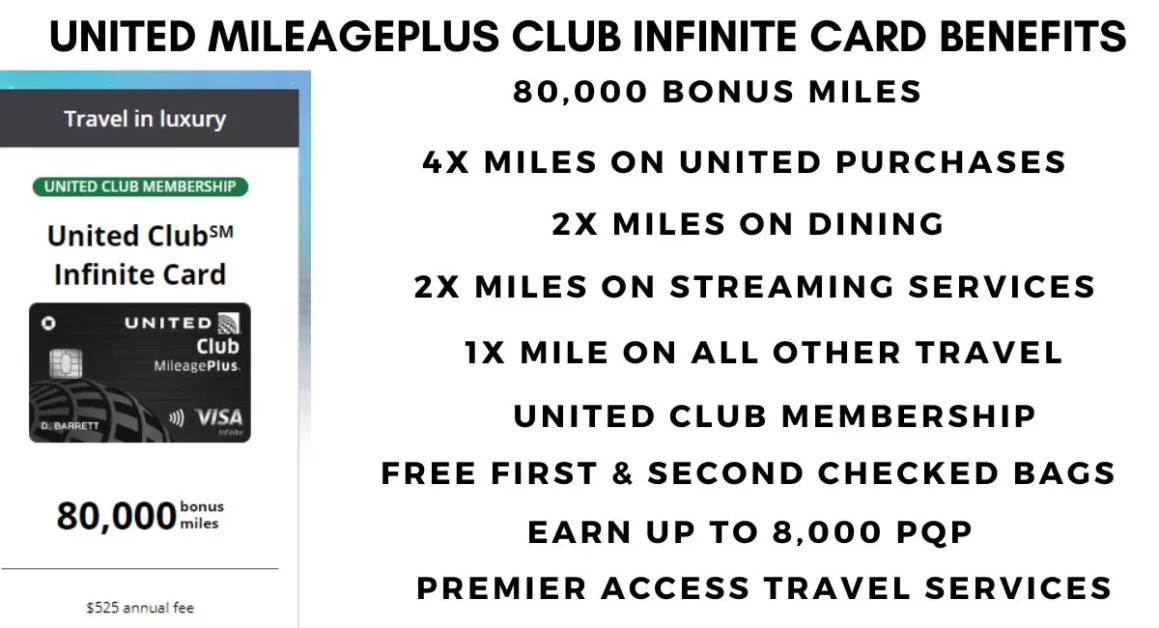

United Club Infinite Card

The United Club Infinite is the premium product of the MileagePlus credit card that is offered to make your travel luxurious. United Club membership is the major attraction of the Club Infinite card.

United Club Membership

Complimentary 1st & 2nd Checked bags

4x miles on United purchases

Up to 8,000 PQP (Premier Qualifying Points)

2x miles on dining and all other travel

Interested customers can apply for the United Club Infinite Card by submitting personal information, and financial details. Talking about eligibility, there is no exact credit score specified for approval.

However, the chance of getting approval is better if your credit score is 720 or higher. Besides, your approval will be based on other various factors such as income, years of credit history, and the number of new accounts opened recently.

United Club Infinite Cardholders can earn 80,000 Bonus miles after spending $5,000 on purchases in the first 3 months of account opening.

United Club Infinite Card Benefits

- Earn 4x miles on United purchases.

- Earn 2x miles on all other travel including airfare, trains, local transit, cruise lines, hotels, car rentals, taxicabs, resorts, ride-share services, and tolls.

- Earn 2x miles on dining including eligible delivery services.

- Earn 1x miles on all other purchases.

- United Club membership (Worth up to $650 per year)

- Complimentary 1st & 2nd checked bags for you and your companion (Savings of up to $320 per round trip).

- Premier Access Travel services include priority check-in, boarding, security screening, and baggage handling privileges.

- Up to $100 Global Entry, TSA PreCheck, or NEXUS fee credit.

- 25% back on United Inflight and Club Premium Drink purchases.

- No Foreign Transaction Fees.

- Earn up to 8,000 PQP (Premier Qualifying Points) to qualify for MileagePlus status levels.

- 10% Savings on United Economy Saver Awards

- No blackout dates for MileagePlus members booking award flights on United.

- No expiration on MileagePlus miles.

- Be eligible for Platinum Elite Status in IHG One Rewards.

- Earn $75 in statement credits as reimbursement for IHG Hotels and Resorts purchases made with the Infinite Club Card in 2023.

- Travel Coverage includes Auto Rental Collision Damage Waiver, Trip Cancellation/Interruption Insurance, Purchase Protection, and more.

- Complimentary Cardmember benefits at luxury hotels, and resorts worldwide.

- Enjoy a 1-year complimentary DashPass (provides unlimited deliveries with $0 delivery fees, and lower service fees on eligible orders).

- Exclusive Cardmember events offered by United Card events from Chase and United MileagePlus Exclusives.

Conclusion on ‘What are the benefits of the United MileagePlus card?’

You can earn MileagePlus award miles, and enjoy various benefits with the United MileagePlus personal credit card products from Chase.

United Gateway is the entry-level product whereas the United Club Infinite Card is the premium product of the United credit card.

You can apply to any of the four MileagePlus personal credit cards (depending on your qualification), start earning miles, and enjoy various benefits.

There is no specific credit score mentioned by United Airlines however, it is recommended that your FICO Credit score must be greater than 670 to get approved for different credit card products. Besides, your approval will be based on other factors such as annual income, years of credit history, and the number of new accounts opened recently.

FAQs on the benefits of the United MileagePlus card

What do United MileagePlus members get?

United MileagePlus status holders, and MileagePlus cardholders enjoy exclusive benefits such as complimentary checked baggage, priority boarding, MileagePlus Bonus miles, United Club access, TSA PreCheck, and more.

Do United Cardholders get priority boarding?

United Explorer Card, Quest Card, and Club Infinite Card offer priority boarding services.

Does the United Explorer card pay for TSA PreCheck?

United Explorer Card offers up to $100 Global Entry, TSA PreCheck, or NEXUS fee credit.

Do United card members get a free carry-on?

United Airlines MileagePlus Premier Status holders and qualifying MileagePlus credit cardholders can bring one free carry-on bag.