One of the major airlines in the United States and a founding member of the Star Alliance is United Airlines, also known as UA or UAL. The airline operates flights to over 300 destinations across the globe from 8 main hubs located in the U.S.

United Airlines provides its frequent flyers with a range of advantageous programs, including the highly regarded MileagePlus Loyalty Program and MileagePlus credit cards.

The focus of our discussion today will be on the criteria and advantages of the different United Airlines Business credit cards.

Table of Contents

What is United MileagePlus Business Card?

United Airlines offers two distinct categories of MileagePlus Credit cards: Personal Credit Cards and Business Credit Cards. Each type of card has unique prerequisites, objectives, and perks.

The United MileagePlus Business Card is specially designed for business owners that offers a variety of benefits such as bonus miles, United Club passes, complimentary checked bags, and more.

Related: Explore United MileagePlus Personal Credit Cards

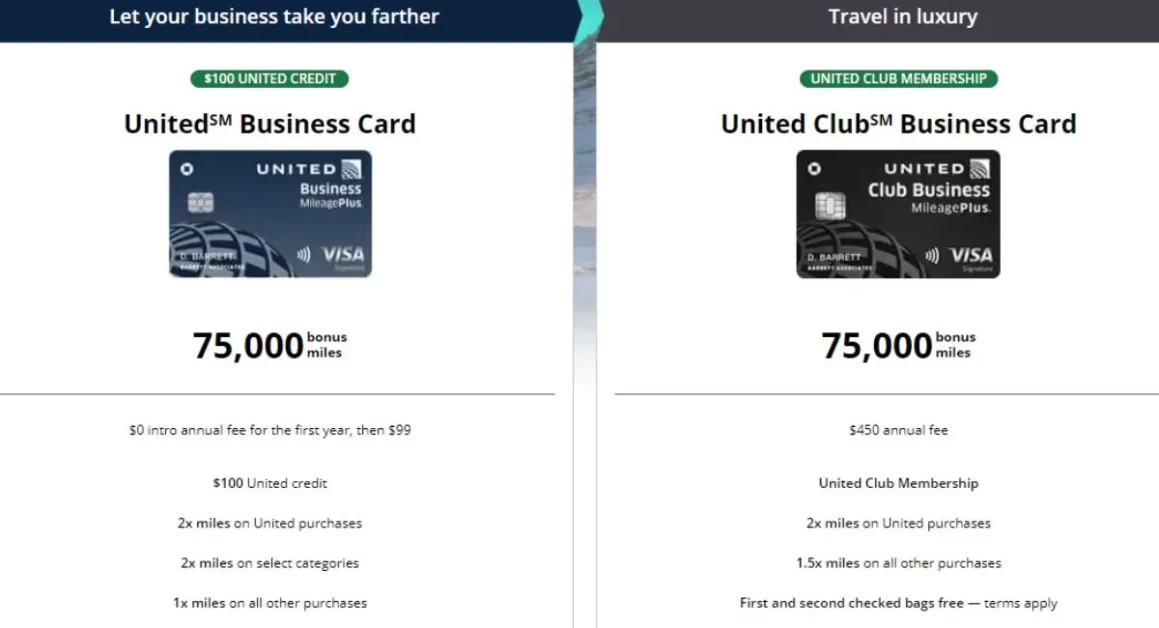

MileagePlus Business credit card is offered to eligible passengers flying on United flights. There are two types of business credit cards which are the United Business Card, and the United Club Business Card.

Now, let’s explore both the MileagePlus Business cards in detail.

United Business Card

The United Business Card is one of the two MileagePlus Business credit card types that is introduced to take your business farther.

75,000 Bonus Miles

Free Checked Baggage

2x miles on purchases

5K Miles better-together anniversary bonus

If you are a small business owner, and would like to receive the United MileagePlus Business card, you can apply for the card online by submitting personal information, financial details, and business information.

There is no specific credit score mentioned by United Airlines for approval however, it is better if your credit score is more than 670. Besides, it is also worth noting that credit scores are just one of the various factors when analyzing your application. Other factors include your income, debt-to-income, credit history, business revenue, and so on.

MileagePlus Business Card can earn 75,000 bonus miles after spending $5,000 on purchases in the first 3 months of account opening.

Important Note: The bonus offer is only available if you do not own the Business card, and have not received a new card member bonus for this card in the past 24 months.

You will get Business Card for a $0 intro annual fee for the first year. After that, $99 is applicable, and the pricing is subject to interest rates, and interest charges.

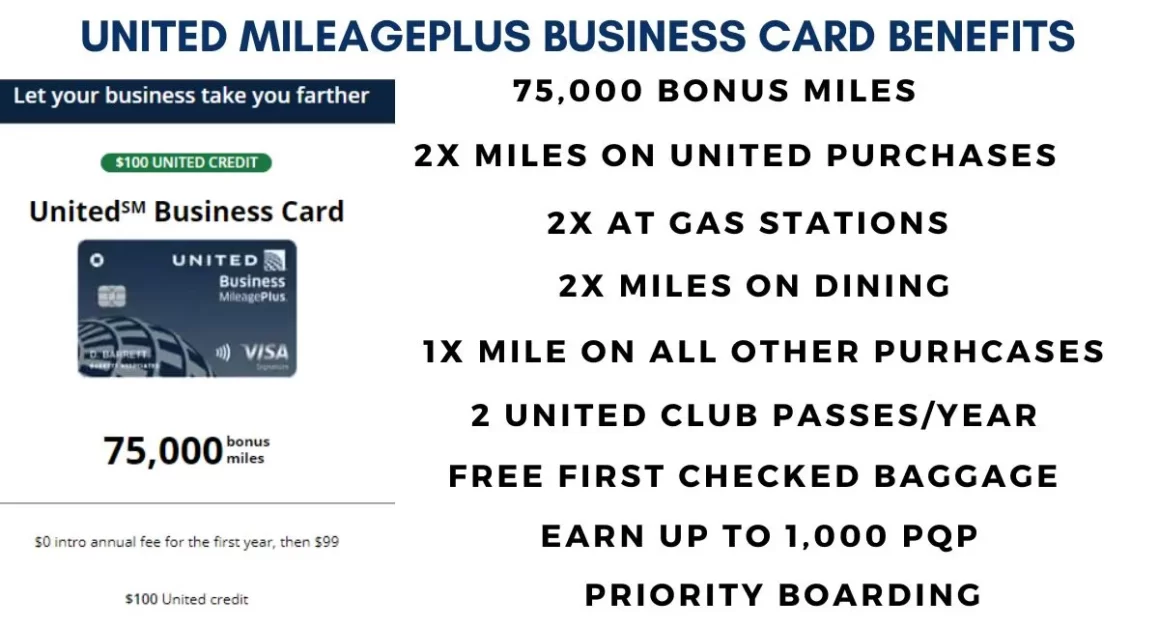

United MileagePlus Business Card Benefits

- $0 intro annual fee for the first year, then $99.

- 75,000 bonus miles after spending $5,000 on purchases in the first 3 months of account opening.

- 5,000 Bonus Miles each card anniversary when you own the United Business Card, and a Personal United credit card.

- Earn 2x miles on United purchases.

- Earn 2x miles at gas stations.

- Earn 2x miles on dining including eligible delivery services.

- Earn 2x miles at office supply stores.

- Earn 2x miles on local transit including ride-share services, taxicabs, train tickets, tolls, and mass transit.

- Earn 1x mile on all other purchases.

- Receive employee cards at no additional cost.

- Miles earned with purchases from Employee cards accrue in your account to expedite your rewards.

- 2 United Club one-time passes per year ($100+ Value)

- Free First Checked Bag for you and your companion (Up to $140 savings per roundtrip).

- Priority Boarding

- $100 United Travel Credit after 7 United flight purchases of $100 or more each card anniversary year.

- 25% back on United inflight and Club premium drink purchases.

- No Foreign Transaction fees.

- Earn up to 1,000 PQP (Premier Qualifying Points) to qualify for United Premier status.

- No Blackout dates for MileagePlus members booking award flights on United.

- No expiration on MileagePlus miles.

- Travel & Purchase Coverage including Auto Rental Collision Damage Waiver, Trip Cancellation/Interruption Insurance, Purchase Protection and more.

- Complimentary Cardmember benefits at luxury hotels, and resorts worldwide.

- 1-year complimentary DashPass.

- Exclusive Cardmember events from Chase, and United MileagePlus Exclusives.

United Club Business Card

As the name suggests, the United Club Business card is there to fulfill your luxury travel needs with the United Club membership worth up to $650 per year.

United Club Membership

2 Free Checked Bags

Premier Access Travel Services

2x miles on United purchases

1.5x miles on all other purchases

United customers interested in the Club Business Card can apply online by submitting personal information, financial details, and business information.

A good to excellent credit score is recommended to get approval for the United Club Business Card. However, it’s worth noting that credit scores are just one factor that airlines consider when evaluating applications. They also consider other factors such as your income, employment history, business revenue, credit utilization, and payment history.

United MileagePlus Club Business cardholders can earn 75,000 bonus miles after spending $5,000 on purchases in the first 3 months of account opening.

Important Note: The bonus offer is only available if you do not own the Business card, and have not received a new card member bonus for this card in the past 24 months.

The annual fee for using the United Club Business Card is $450. The price is subject to interest rates, interest charges, and other fees.

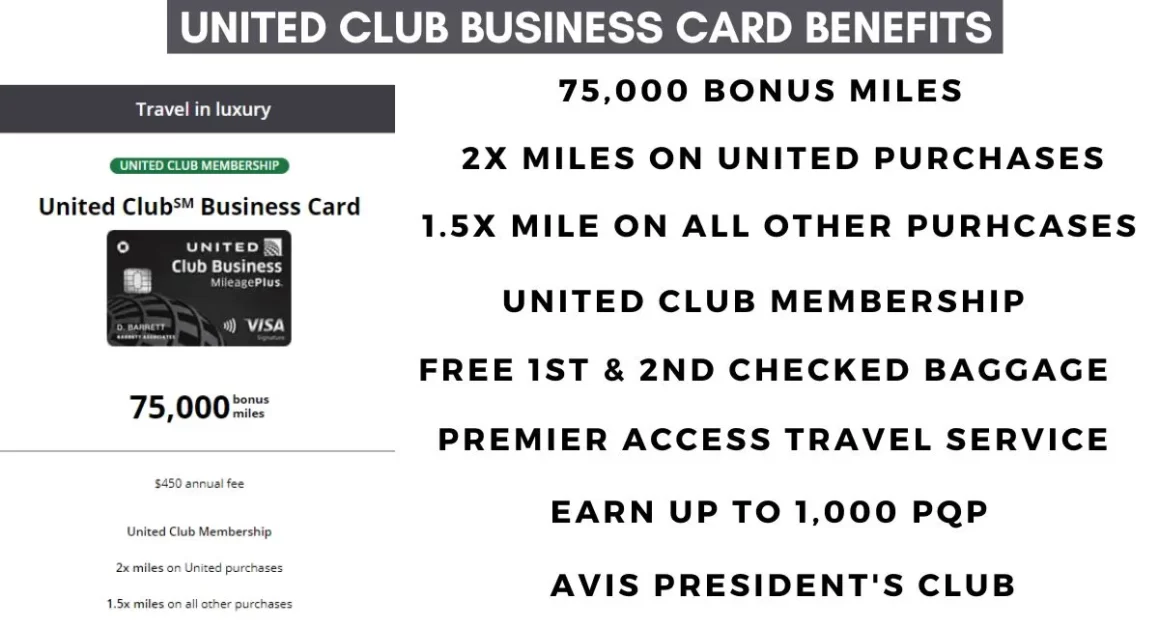

United Club Business Card Benefits

- 75,000 bonus miles after spending $5,000 on purchases in the first 3 months of account opening.

- Earn 2x miles on United purchases.

- Earn 1.5x miles on all other purchases

- Receive employee cards at no additional cost.

- Miles earned with purchases from Employee cards accrue in your account to expedite your rewards.

- United Club Membership worth up to $650 per year.

- Free First, and Second Checked Bag for you and your companion (Up to $140 savings per roundtrip).

- Premier Access Travel Services including Priority Check-in, Security Screening, Boarding, and Baggage Handling Privileges.

- 25% back on United inflight and Club premium drink purchases.

- No Foreign Transaction fees.

- Earn up to 1,000 PQP (Premier Qualifying Points) to qualify for United Premier status.

- No Blackout dates for MileagePlus members booking award flights on United.

- No expiration on MileagePlus miles.

- Travel & Purchase Coverage including Auto Rental Collision Damage Waiver, Trip Cancellation/Interruption Insurance, Purchase Protection and more.

- Avis President’s Club enrolment with complimentary 2-car class upgrades, guaranteed car availability, expedited rental service, and more.

- Complimentary Cardmember benefits at luxury hotels, and resorts worldwide.

- 1-year complimentary DashPass.

- Exclusive Cardmember events from Chase, and United MileagePlus Exclusives.

United Business Card vs United Club Business Card

| COMPARISON | UNITED BUSINESS CARD | UNITED CLUB BUSINESS CARD |

| Annual Fee | $0 intro annual fee for the first year, then $99 (interest rates & charges applicable) | $450 annual fee |

| Earning on all Purchases | 2x on United Purchases 2x at gas stations, dining, eligible delivery services, local transit, and commuting. 1x on all purchases | 2x on United Purchases 1.5x on all other purchases |

| Better-together bonus | 5,000 Bonus Miles each card anniversary when you have the United Business Card, and a personal United Card | N/A |

| United Club Access | 2 United Club one-time passes per year ($100+ Value) | United Club Membership (Up to a $650 value per year) |

| Credit Card Travel Benefits | Free 1st Checked Bag (Up to $140 savings per roundtrip) Priority Boarding $100 United Travel Credit 25% back on United inflight and Club premium drink purchases. | Free 1st & 2nd Checked Bag (Up to $320 savings per roundtrip) Premier Access Travel Services including priority check-in, security screening, boarding, and baggage handling privileges. 25% back on United inflight and Club premium drink purchases. Avis President’s Club enrolment. |

| Employee Cards | Offered at no additional cost. | Offered at no additional cost. |

| MileagePlus Program Benefits | Up to 1,000 PQP No Blackout dates MileagePlus miles don’t expire | Up to 1,000 PQP No Blackout dates MileagePlus miles don’t expire |

| Foreign Transaction Fees | Waived | Waived |

| DashPass Membership from DoorDash | 1-year complimentary membership | 1-year complimentary membership |

Conclusion on the United MileagePlus Business Card Benefits

United Airlines offers various MileagePlus credit cards to enhance your travel experience. If you are a small business owner, you can apply for the United Business credit card, and enjoy the exclusive benefits.

Among the two Business credit cards, you can choose one depending on your eligibility, and requirements. For instance, United Club Business Card is best for you if your requirement is to enjoy the United Club experience and access more exclusive benefits. Otherwise, you can go for United Business Card.

If you are not a business owner, there are various United MileagePlus Personal credit cards available with a wide range of benefits.

FAQs on United MileagePlus Business Card Benefits

What credit score do you need for United Business Credit card?

A good to excellent credit score is recommended for the United Business Credit Card. It is better if your credit score is greater than 670. Besides, there are various other factors such as business revenue, credit history, payment history, and so on for approval.

What is the limit on United Business Card?

The credit limit for the United Business Credit Card starts at $5,000 and can be higher for creditworthy applicants. While a credit limit of at least $5,000 is guaranteed for all approved United Business Credit Card applicants, some may qualify for higher limits based on their creditworthiness and other factors.

Does United Business Card report to personal credit?

Yes, the United Business Card typically reports to your personal credit report. As with most business credit cards, your personal credit history will likely be considered when you apply for a United Business Card, and your activity and payment history with the card will typically be reported to the major credit bureaus (Experian, Equifax, and TransUnion).

This means that your credit utilization, payment history, and other factors associated with your use of the card can affect your personal credit score. However, it’s worth noting that some business credit cards may report only to commercial credit reporting agencies, so it’s always a good idea to check with the issuer to confirm how your use of the card will be reported.

How hard is it to get a United Credit Card?

If you have a good credit score, and sufficient income, it is not that difficult to get approved for the United Credit cards.