American Airlines (AA or AAL) is the major carrier in the United States, and also the founding member of the Oneworld Alliance. AA operates 7,000+ daily flights to more than 350 destinations across 50 countries.

Passengers flying on AA are offered various loyalty programs such as AAdvantage Status and AAdvantage Credit Cards. Gold, Platinum, Platinum Pro, and Executive Platinum are the levels of the AAdvantage Status.

Likewise, AAdvantage Cards include Citi/AAdvantage Credit Cards and AAdvantage Aviator Cards. Today, we are going to explore the benefits of the AAdvantage cards with their requirements.

If you are an American Airlines frequent flyer, don’t forget to check out the benefits of AAdvantage Credit cards which offer lots of benefits.

Table of Contents

What are the Citi/AAdvantage Credit cards?

AAdvantage Credit Cards are the part of AAdvantage Program that allows eligible customers to own credit cards, and start earning miles. The earned miles can be redeemed for various benefits offered by American Airlines.

New customers for the AAdvantage Credit Cards can apply for various Citi/AAdvantage Cards listed below.

- American Airlines AAdvantage MileUp Mastercard (Best for Everyday Purchases)

- Citi/AAdvantage Platinum Select Mastercard (For Travel Needs)

- Citi/AAdvantage Executive Mastercard (Best Value for Admirals Club Membership)

- CitiBusiness/AAdvantage Platinum Select Mastercard (For Business Owners)

Customers wanting to obtain an AAdvantage Credit card need to hold an excellent credit history. A FICO Credit Score of 670+ is recommended to get approved for AAdvantage credit cards provided that they have proof of enough income to afford monthly bill payments.

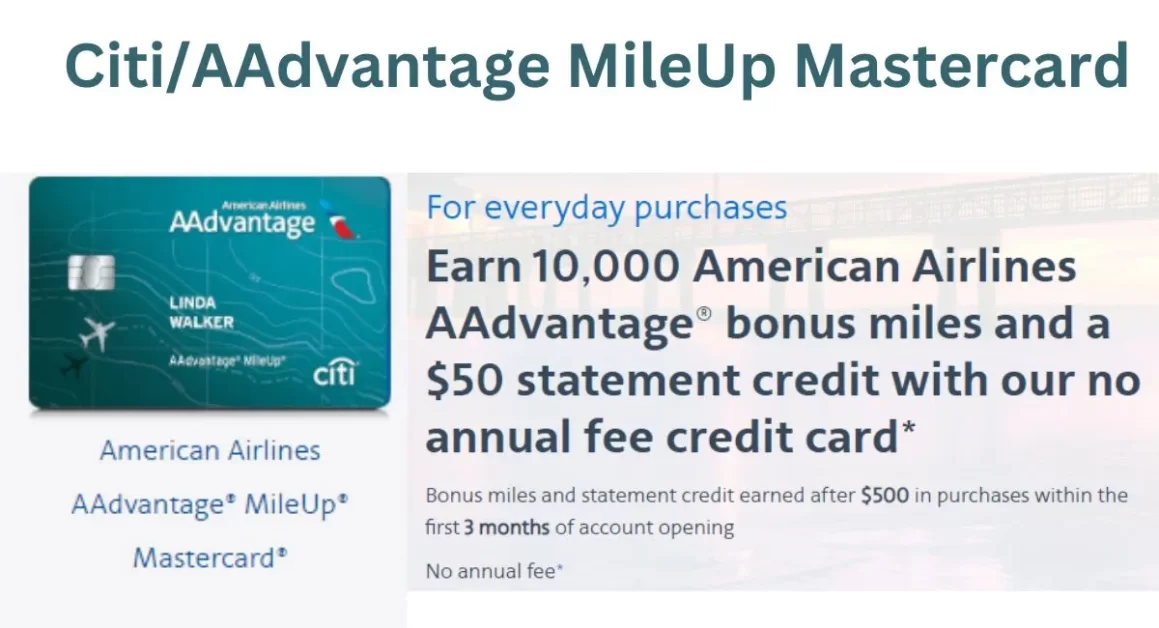

AAdvantage MileUp Mastercard (For Everyday Purchases)

The MileUp Mastercard is the base level of the MileUp Mastercard that doesn’t require an annual fee. You can apply for this card online via American Airlines’ official website. You are required to enter your personal details and financial information.

Once approved, you will get an account number and temporary credit limit to use on travel immediately.

MileUp Mastercard holders can earn 10,000 American Airlines AAdvantage Bonus Miles, and also receive a $50 statement credit after making purchases of %500 within the first 3 months of account opening.

Important Note: Statement credit and American Airlines AAdvantage bonus miles are not available if you have received a statement credit or American Airlines AAdvantage bonus miles for a new AAdvantage MileUp account in the past 48 months.

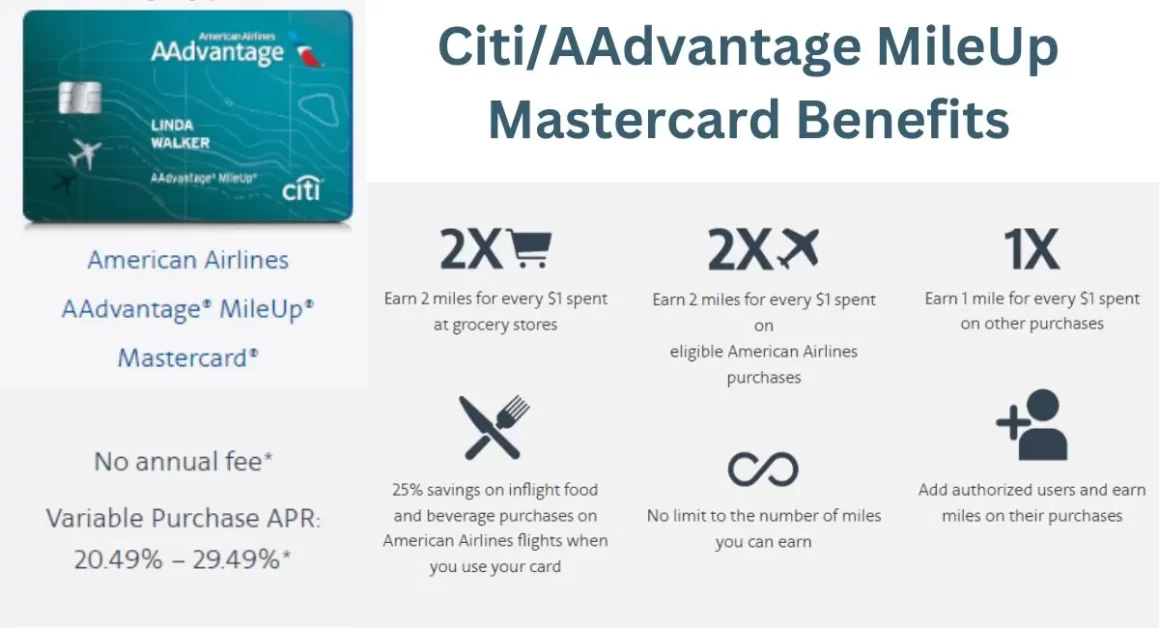

Benefits of the MileUp Mastercard

- Earn 2 miles for every $1 spent at grocery stores

- Earn 2 miles for every $1 spent on eligible American Airlines purchases

- Earn 1 mile for every $1 spent on other purchases

- Earn 1 Loyalty Point for Every 1 Eligible Mile earned from purchases

- 25% savings on inflight food and beverage purchases on American Airlines flights when you use your card

- No Limit to the number of miles you can earn

- Add Authorized users and earn miles on their purchases

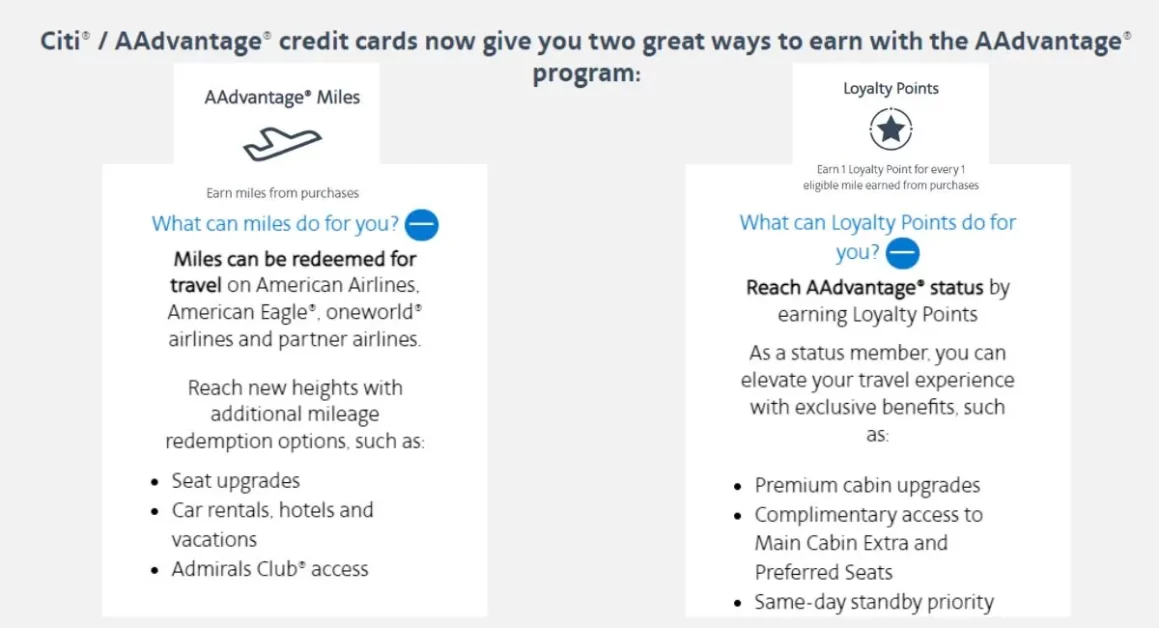

In addition to the above benefits, customers can use the miles earned from purchases made with MileUp Mastercard to redeem for travel and reach AAdvantage status.

Miles earned with a MileUp credit card can be redeemed for travel on American Airlines, American Eagle, Oneworld airlines, and partner airlines. Besides, the miles can also be used for various other redemption options such as seat upgrades, Admirals Club access, car rentals, hotels, and vacations.

On the other hand, loyalty points earned with the credit card can be used to reach AAdvantage status. There are various levels of the AAdvantage Status loyalty program offering exclusive benefits.

Citi/AAdvantage Platinum Select Mastercard (For Travel Needs)

The Platinum Select Mastercard is another AAdvantage Credit card option that comes with more benefits than the MileUp Card. A FICO credit score of 700 or higher, and proof of adequate monthly income are mandatory to get approved for this credit card.

If you get approved, you will immediately receive an account number and a temporary minimum credit limit to use on travel.

Platinum Select credit card holders can earn 50,000 American Airlines AAdvantage Bonus Miles after making purchases worth $2,500 within the first 3 months of account opening. The annual fee is waived for the first year.

Important Note: American Airlines AAdvantage® bonus miles are not available if you have received a new account bonus for a Citi/AAdvantage Platinum Select account in the past 48 months.

Benefits offered by the AAdvantage Platinum Select Mastercard

- First Checked Bag free on domestic American Airlines itineraries for you and up to 4 travel companions on the same reservation (Up to $300 savings per round trip).

- Preferred Boarding on American Airlines flights.

- 25% savings on inflight food and beverage purchases on American Airlines flights when you use your Platinum select card.

- Earn 2 miles for every $1 spent at restaurants and gas stations.

- Earn 2 miles for every $1 spent on eligible American Airlines purchases.

- Earn 1 mile for every $1 spent on other purchases.

- Earn 1 Loyalty Point for Every 1 Eligible Mile earned from purchases.

- Earn a $125 American Airlines Flight Discount after spending $20,000 or more in purchases during the card membership year, and renewal.

- No foreign transaction fees on purchases.

- Add authorized users to your account at no additional charge.

AAdvantage miles earned from purchases made with Platinum Select Mastercard can be redeemed for travel on American Airlines, American Eagle, Oneworld airlines, and partner airlines. Other redemption options include seat upgrades, car rental, hotel & vacation packages, and Admirals Club Access.

Likewise, Loyalty Points can be used to reach various AAdvantage Status levels that offer exclusive benefits.

Citi/AAdvantage Executive Mastercard (Value for Admirals Club Membership)

AAdvantage Executive Mastercard is advertised as the best value for Admirals Club membership.

If you hold a credit score of at least 700, you have the chance to get approved for the AAdvantage Executive Mastercard provided that you earn enough to afford your monthly bills.

Like other credit cards, you will get an account number, and a temporary minimum credit limit to use on travel immediately after getting approved.

Executive Mastercard holders can earn 50,000 American Airlines AAdvantage Bonus Miles after $5,000 in purchases within the first 3 months of account opening. An annual fee of $450 is applicable with other charges.

Important Note: American Airlines AAdvantage bonus miles are not available if you have received a new account bonus for a Citi/AAdvantage Executive account in the past 48 months.

Benefits of the AAdvantage Executive Mastercard

- Admirals Club Membership (worth up to $650).

- Global Entry or TSA PreCheck application fee credit up to $100 every 5 years.

- First Checked Bag free on domestic American Airlines itineraries for you and up to 8 travel companions on the same reservation (Up to $540 savings per round trip).

- Priority Boarding on American Airlines Flights.

- Priority Check-in, and Priority Airport Screening for you and up to 8 travel companions.

- 25% Savings on inflight food, and beverage purchases on AA flights when you use Executive Mastercard.

- Earn 2 miles for every $1 spent on eligible American Airlines purchases.

- Earn 1 mile for every $1 spent on other purchases.

- Earn 10,000 additional Loyalty Points after spending $40,000 in purchases during the qualifying status year.

- Earn 1 Loyalty Point for Every 1 Eligible Mile earned from purchases.

- Dedicated Concierge Service including assistance for domestic and foreign travel, shopping, dining, household, and entertainment needs.

- No Foreign Transaction fees on purchases.

- Add authorized users to your card and earn miles on their purchases.

Miles earned after making purchases with an AAdvantage Executive card can be redeemed for travel, Admirals Club Access, seat upgrades, car rental, hotel bookings, and reaching AAdvantage Status levels.

CitiBusiness/AAdvantage Platinum Select Mastercard (For Business Owners)

This credit card is for business owners so, you need to submit your business information including business details, business financial information, and other personal information.

If you are applying for the CitiBusiness/AAdvantage Platinum Select Mastercard, you must hold a credit score of 750+, and provide genuine financial proof.

If approved, you will receive an account number, and a temporary minimum credit limit to use on travel immediately.

CitiBusiness/AAdvantage Platinum Select Mastercard can earn 65,000 American Airlines AAdvantage Bonus Miles after $4,000 in purchases within the first 4 months of account opening.

Important Note: American Airlines AAdvantage bonus miles are not available if you have received a new account bonus for a CitiBusiness/AAdvantage Platinum Select account in the past 48 months.

Benefits of CitiBusiness/AAdvantage Platinum Select Mastercard

- First Checked Baggage free on domestic American Airlines flights for you and up to 4 travel companions on the same reservation (Savings of up to $300 per round trip).

- Preferred Boarding on AA flights.

- 25% savings on AA inflight Wi-Fi purchases when you use your card.

- 25% Savings on Inflight Food and Beverage purchases on AA flights when using the card.

- AA Companion Certificate for domestic travel after spending $30,000 or more in purchases each card membership year, and renewal.

- No Foreign Transaction fees on overseas purchases.

- Earn 2 miles for every $1 spent on cable and satellite providers.

- Earn 2 miles for every $1 spent on eligible AA purchases.

- Earn 2 miles for every $1 spent at gas stations.

- Earn 2 miles for every $1 spent on select telecommunications merchants.

- Earn 2 miles for every $1 spent on car rentals.

- Earn 1 mile for every $1 spent on other purchases.

- Earn 1 Loyalty Point per eligible AAdvantage mile earned on purchases.

- Earn more miles with purchases made by employees on authorized user cards.

- 24/7 Personal Business Assistant

- Summary of monthly, or yearly transactions.

- Special offers on Microsoft, Salesforce, Intuit, and more.

Miles earned after making purchases with a CitiBusiness/AAdvantage Platinum Select Mastercard can be redeemed for travel, Admirals Club Access, seat upgrades, car rental, hotel bookings, and reaching AAdvantage Status levels.

Conclusion on ‘What are the benefits of the AAdvantage Card?’

We explored the American Airlines AAdvantage Credit Cards with their requirements and benefits. If you are a frequent flyer, you can obtain a credit card and enjoy various benefits.

But remember, you need to have a good or excellent credit score to get approved for the AAdvantage Credit Cards. Besides, you must also have strong financial proof to support your monthly expenditure.

Depending on your eligibility, you can go for MileUp Mastercard, Platinum Select Mastercard, Executive MasterCard, or CitiBusiness AAdvantage Mastercard.

FAQs on the benefits of the American Airlines Credit Card

Does the American Airlines credit card give you priority boarding?

American Airlines AAdvantage Executive Mastercard holders get priority boarding service on AA-operated flights. Besides, they also receive priority check-in and priority airport screening.

Do I have to use my AAdvantage Card to get free bags?

Platinum Select, Executive, and CitiBusiness Platinum Select credit cards offer the first checked bag for free. If you own any of these credit cards, you can use them to get free bags.

Is it hard to get an American Airlines credit card?

Getting an American Airlines Credit Card is not that complicated if you hold a good FICO Credit Score (670+), and have enough income.