American Airlines (AA or AAL) is the leading airline carrier in the United States and one of the founding members of the Oneworld Alliance. With over 7,000 daily flights servicing more than 350 destinations across 50 countries, AA offers a comprehensive travel network to its passengers.

AA provides various loyalty programs, including AAdvantage Status and AAdvantage Credit Cards, to enhance the flying experience for its passengers.

American Airlines Barclays Credit Card is the type of AAdvantage Credit Cards program that is offered by Barclays Bank.

Let’s find out why the American Airlines Barclays Credit card is a must-have for frequent flyers.

Table of Contents

What is the American Airlines Barclays Credit Card?

American Airlines has partnered with Barclays Bank to offer a travel rewards credit card to valuable customers. The rewards credit card is known as the AAdvantage Aviator Mastercard.

The Aviator Card provides a wide range of benefits to frequent flyers of American Airlines that includes bonus miles, companion certificates, complimentary checked baggage, priority boarding, and more.

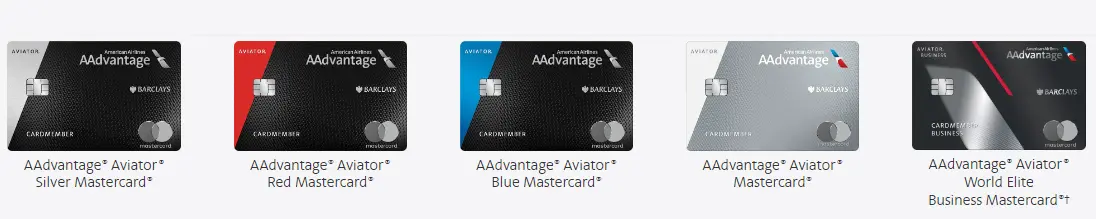

The American Airlines Barclays Credit Card is available in several different versions, each with different benefits and annual fees.

Here are the types of American Airlines Barclays Credit Card

- AAdvantage Aviator Mastercard

- AAdvantage Aviator Silver Mastercard

- AAdvantage Aviator Red Mastercard

- AAdvantage Aviator Blue Mastercard

- AAdvantage Aviator World Elite Business Mastercard (For Commercial use)

The following table shows the varieties of the American Airlines Barclays Credit Card with their availability, and annual fee.

| TYPES OF AA BARCLAYS CREDIT CARD | AVAILABILITY | ANNUAL FEE |

| Aviator Mastercard | Not Available to new applicants | No Annual Fee |

| Aviator Blue Mastercard | Not Available to new applicants | $49 |

| Aviator Silver Mastercard | Not Available to new applicants | $199 |

| Aviator Red Mastercard | Available to new applicants | $99 |

| Aviator World Elite Business Mastercard | Available to new applicants | $95 |

Now, let’s explore the requirements, and benefits of each Aviator Mastercard.

AAdvantage Aviator Mastercard

Aviator Mastercard is the entry-level product of the AAdvantage Aviator credit card with which customers can earn miles on their purchases with no annual fee.

This entry-level Aviator Credit card is not available for new accounts, or users. Those customers closing an account for other cards (possibly due to annual fees) can downgrade to this basic Aviator Mastercard.

Customers holding the AAdvantage Aviator Mastercard can earn miles on all their purchases. The earned miles can be redeemed on travel and earn Loyalty Points to qualify for different levels of the AAdvantage Status Loyalty Program.

Benefits of the AAdvantage Aviator Mastercard

- Earn 1X AAdvantage Miles for every $1 spent on eligible American Airlines purchases

- Earn 1X AAdvantage Miles for every $2 spent on all other purchases

- $0 Fraud Liability Protection (You’re not responsible for charges you didn’t authorize)

- 25% Savings on Inflight Food, and Beverage Purchases on AA-operated flights.

- Earn 1 Loyalty Point for every 1 eligible mile earned from purchases.

- 10% Discount on eligible American Airlines vacations package.

- Great deals for Car Rentals, and Hotel Stays.

- Earn miles faster when dining at local restaurants.

- Earn miles faster by shopping at 950+ online stores.

- Option to join SimplyMiles and earn miles faster on purchases by activating offers and shopping your favorite brands in-store and online.

AAdvantage Aviator Blue Mastercard

A FICO credit score of 690+ is recommended to get the American Airlines Barclays Credit Card including the Aviator Blue Mastercard.

The Aviator Blue Mastercard is also unavailable for new users. Only existing cardholders can obtain this card when they are opting for a downgrade or a product change.

The annual fee for using the AAdvantage Aviator Blue Mastercard is $49.

Benefits offered by the Aviator Blue Mastercard

- Earn 2X AAdvantage Miles for every $1 spent on eligible American Airlines purchases.

- Earn 1X AAdvantage Miles for every $1 spent on all other purchases.

- Earn 1 Loyalty Point for every 1 eligible mile earned from purchases.

- 25% savings on inflight food, and beverage purchases when using Blue Mastercard on AA-operated flights.

- No Foreign Transaction Fees on International Purchases

- $0 Fraud Liability Protection

- 10% Discount on eligible American Airlines vacations package.

- Great deals for Car Rentals, and Hotel Stays.

- Earn miles faster when dining at local restaurants.

- Earn miles faster by shopping at 950+ online stores.

- Option to join SimplyMiles and earn miles faster on purchases by activating offers and shopping your favorite brands in-store and online.

AAdvantage Aviator Silver Mastercard

Customers wanting to receive AAdvantage Aviator Silver Mastercard need to hold a good credit score of at least 720. Plus, they must show proof of adequate income to get approved.

Aviator Silver Mastercard is also not available to new applicants. You can only use this Mastercard if you are downgrading or changing a product. The annual fee for Silver Mastercard is $199.

Benefits of the AAdvantage Aviator Silver Mastercard

- Earn 3X AAdvantage miles for every $1 spent on eligible AA purchases.

- Earn 2X AAdvantage miles for every $1 spent on hotels, and car rentals.

- Earn 1X AAdvantage miles for every $1 spent on all other purchases.

- Earn 1 Loyalty Point for every 1 eligible mile earned from purchases.

- Round up your purchases to the nearest dollar to get more AAdvantage miles with the Flight Cents.

- No limit to the number of AAdvantage miles you can earn.

- Earn up to 15,000 additional Loyalty Points after qualifying to spend each status qualification period.

- Up to $25 discount as statement credits on inflight food, and beverage purchases when you use Silver Mastercard on AA-operated flights.

- Up to %50 back as statement credits on inflight Wi-Fi purchases every anniversary year on AA-operated flights.

- Earn a Companion Certificate each anniversary year if you spend $20,000 on purchases, and your account remains open for 45 days after your anniversary date. The Companion Certificate is good for 2 guests at $99 each (plus taxes and fees).

- A $100 Global Entry Application Fee credit once every 5 years.

- Complimentary first-checked baggage on AA domestic flights for you and up to 8 companions traveling on the same reservation.

- Preferred Boarding for you and up to 8 companions on your reservation for all AA-operated flights.

- $0 Fraud Liability Protection (You’re not responsible for charges you didn’t authorize)

- No Foreign Transaction fees on international purchases.

- Enjoy Luxury Travel Benefits, World Elite Concierge, and U.S.-based Customer Service.

- 10% Discount on eligible American Airlines vacations package.

- Great deals for Car Rentals, and Hotel Stays.

- Earn miles faster when dining at local restaurants.

- Earn miles faster by shopping at 950+ online stores.

- Option to join SimplyMiles and earn miles faster on purchases by activating offers and shopping your favorite brands in-store and online.

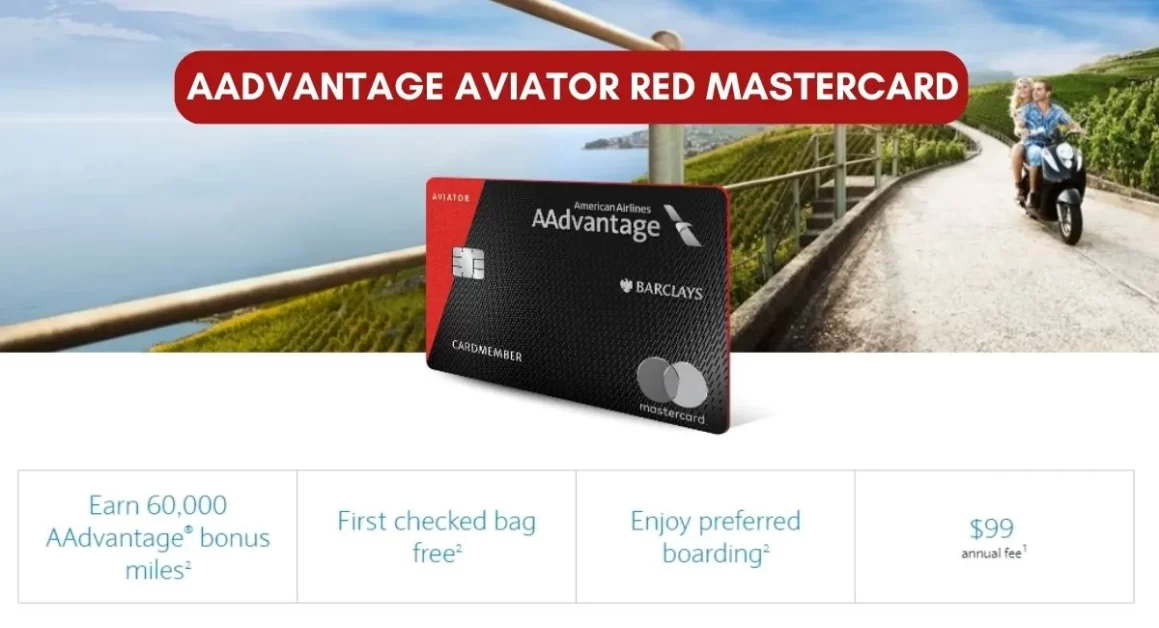

AAdvantage Aviator Red Mastercard

60,000 AAdvantage Bonus miles, complimentary checked baggage, and preferred boarding are the major attractions of the AAdvantage Aviator Red Mastercard.

Aviator Red Mastercard is one of the two Aviator Credit cards that is offered to new users or applicants.

If you become an Aviator Red card member, you will receive exclusive benefits. To get approved for this Mastercard, you must hold a credit score of at least 690, and provide sufficient financial proof.

Aviator Red Mastercard holders can earn 60,000 AAdvantage Bonus miles after making their first purchase and paying an annual fee of $99 in full (both within the first 90 days).

Benefits of the AAdvantage Aviator Red Mastercard

- Earn 2X AAdvantage miles for every $1 spent on eligible AA purchases.

- Earn 1X AAdvantage miles for every $1 spent on hotels, and car rentals.

- Earn 1 Loyalty Point for every 1 eligible mile earned from purchases.

- Round up your purchases to the nearest dollar to get more AAdvantage miles with the Flight Cents.

- No limit to the number of AAdvantage miles you can earn.

- 25% savings on inflight food, and beverage purchases when using Red Mastercard on AA-operated flights.

- Up to $25 back as statement credits on inflight Wi-Fi purchase each anniversary year on AA-operated flights.

- Earn a Companion Certificate for 1 guest at $99 (plus taxes and fees) if you speed $20,000 on purchases and your account remains open for 45 days after your anniversary date.

- First Checked Bag for free on AA-operated domestic flights for you and up to 4 companions on the same reservation.

- $0 Fraud Liability Protection.

- No Foreign Transaction Fees on international purchases.

- 10% Discount on eligible American Airlines vacations package.

- Great deals for Car Rentals, and Hotel Stays.

- Travel and Lifestyle Services

- Earn miles faster when dining at local restaurants.

- Earn miles faster by shopping at 950+ online stores.

- Option to join SimplyMiles and earn miles faster on purchases by activating offers and shopping your favorite brands in-store and online.

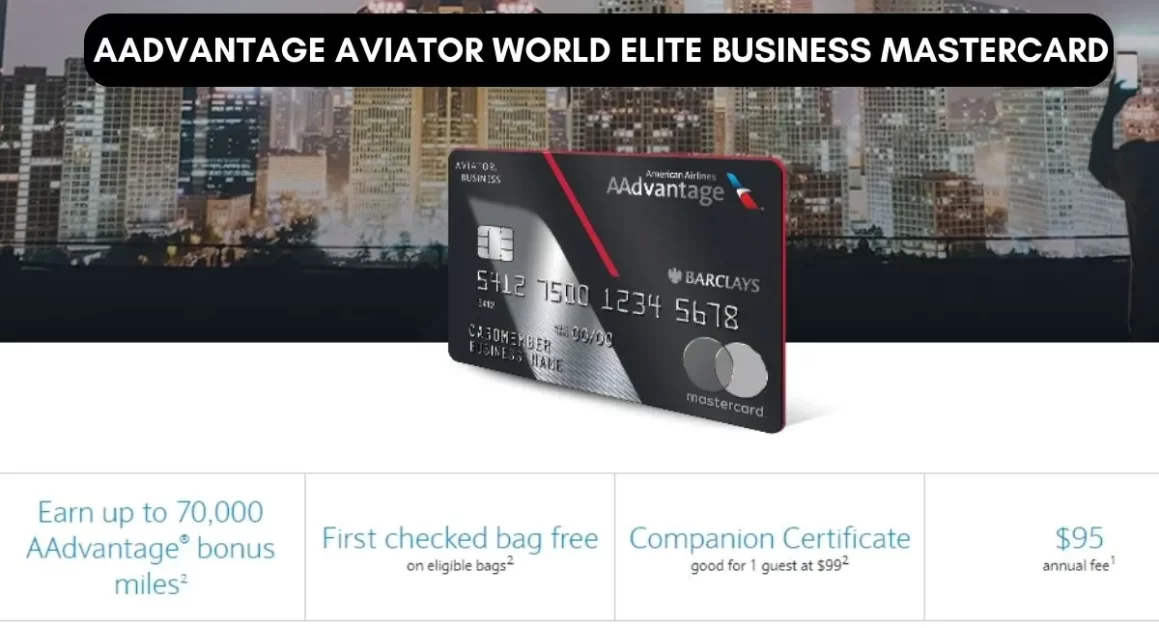

AAdvantage Aviator World Elite Business Mastercard

AAdvantage Aviator World Elite Business Mastercard holders can earn up to 70,000 AAdvantage Bonus Miles after spending $2,000 on purchases in the first 90 days, and earn 10,000 bonus miles after a purchase is made on an employee card.

Aviator Business Mastercard is another Aviator card available to new applicants, and primarily used for commercial purposes. It is a type of American Airlines Barclays Credit Card offered to small-business owners.

Those seeking this World Elite Business Mastercard must ensure they hold a FICO credit score of at least 720. Personal information, business details, annual business revenue, business address, and other important information are required to get approved for the Business Mastercard.

The annual fee for the World Elite Business Mastercard is $95.

Here are the benefits of the AAdvantage Aviator World Elite Business Mastercard

- Earn 2X AAdvantage Miles for every $1 spent on eligible AA purchases.

- Earn 2X AAdvantage Miles for every $1 spent on select telecom, office supply, and car rentals.

- Earn 1X AAdvantage Miles for every $1 spent on all other purchases.

- Earn 1 Loyalty Point for every 1 eligible mile earned from purchases.

- First Checked Baggage is Free for you and up to 5 companions traveling with you on the same reservation on AA-operated flights.

- Complimentary Employee Cards

- Preferred boarding for you, and up to 24 companions traveling on the same reservation on AA-operated flights.

- 25% savings on inflight food, and beverage purchases when using Business Mastercard on AA-operated flights.

- Companion Certificate for 1 Guest at $99 (issued each year after your account anniversary) if you spend $30,000 or more on eligible purchases.

- Earn a 5% AAdvantage Mileage Bonus every year after your account anniversary date based on the total number of miles earned using your Business Mastercard.

- No Foreign Transaction Fees on international purchases.

- $0 Fraud Liability Protection

- 10% Discount on eligible American Airlines vacations package.

- Great deals for Car Rentals, and Hotel Stays.

- Travel and Lifestyle Services

- Earn miles faster when dining at local restaurants.

- Earn miles faster by shopping at 950+ online stores.

- Option to join SimplyMiles and earn miles faster on purchases by activating offers and shopping your favorite brands in-store and online.

Conclusion on the American Airlines Barclays Credit Card

As we are at the end of this informative article, we explored five different versions of the American Airlines Barclays Credit Card including the AAdvantage Aviator Mastercard, AAdvantage Aviator Blue Mastercard, AAdvantage Aviator Silver Mastercard, AAdvantage Aviator Red Mastercard, and AAdvantage Aviator World Elite Business Mastercard.

All these Aviator Cards offer lots of benefits including AAdvantage bonus miles, complimentary checked baggage, preferred boarding, car rental discounts, and various other travel benefits.

If you are confused about which one is better for you, there are only two options available for new applicants. Aviator Red Mastercard and Aviator World Elite Business Mastercard are the only two Aviator Credit cards that accept new users, or applicants.

If you are a new applicant and own a legit business with a good financial structure, you can apply to the World Elite Business Mastercard. Otherwise, Aviator Red Mastercard is the only option for you.

Other cards including Aviator Mastercard, Silver Mastercard, and Blue Mastercard can only be used if you are downgrading your Aviator Card service or initiating a product change.

FAQs on American Airlines Barclays Credit Card

Does the Aviator Card have lounge access?

American Airlines AAdvantage Aviator Cards offer mileage benefits, travel benefits, and various other AAdvantage Program benefits. However, you don’t get lounge access with the Aviator Card at the moment.

Does American Airlines Aviator Card cover rental car insurance?

American Airlines AAdvantage Aviator Red World Elite Mastercard offers travel coverage benefits including Auto Rental Collision Damage Waiver, Travel Accident Insurance, Trip Cancellation, and Interruption Coverage.

Does Barclays American Airlines Credit Card pay for TSA PreCheck?

Yes, the Barclays American Airlines Credit Card does offer a statement credit for the application fee for TSA PreCheck or Global Entry. Cardmembers can receive up to $100 as a statement credit every five years for either program. To qualify for the credit, you need to use your Barclays American Airlines Credit Card to pay the application fee for TSA PreCheck or Global Entry.

What credit score is needed for American Airlines Barclays Credit Card?

A good to excellent credit score is required for the American Airlines Barclays Credit Card. The credit score must correspond to a FICO score of 690 to 850.